Home price appreciation has created significant equity gains for homeowners over the past few years. The market changes in home values over the past few years has given many record amounts of housing wealth. That’s great for your home value over the last two years, but what if you’ve had the home for a while? How much equity do you really have?

As The Equity Master, I pride myself on helping my clients not only understand their equity equations, but learn how to harness the power of equity to build more.

How Your Equity Grows

Let’s start with the basics. Home equity gains are built through price appreciation and by paying off the mortgage through principal payments. That means you also build equity over time as you pay down your home loan.

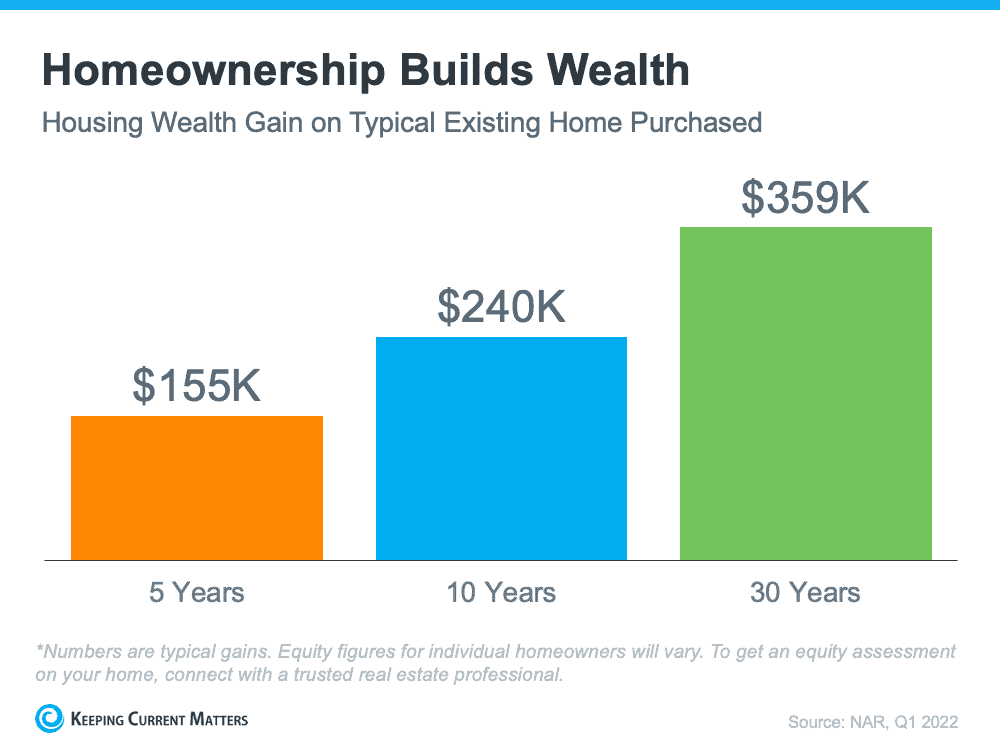

Let’s take a typical, average example of a middle priced home bought, 5, 10 and 30 years ago and is still owned today.

The numbers are impressive and it’s enough money to help you move into or buy your next home. But they’re not a guaranteed amount. Remember, your own equity gain will be different based on how long you’ve been in the house, the condition of your home, upgrades you’ve made, the area you live in and more.

Understanding your equity and how to use your gains to build more equity is where I come in. I can help you assess your home and figure out how much equity you really have. I can

then give you my expert opinion on what your house is worth, how much equity you’ve gained over time and help you purchase your next property.

Final Thoughts

If you’re thinking about selling your house and making a move, home equity can be a game changer – especially if you’ve been living in your home for a while. If you’re ready to figure the equity game out, contact me today and let’s get you on the right track to your future!

Post a comment